Tax experts: Oversight lacking

For the past three weeks, Lincoln County Clerk and Recorder Tammy Lauer has been searching for an explanation as to how districts across the county received tax revenue beyond their voter-approved limits.

At first, Lauer said it was “a combination of errors” that allowed at least three districts to receive more than $1.6 million in excess taxes during the past 15 years. But now, Lauer believes she may have found a previously unknown loophole in state law absolving the county of legal blame.

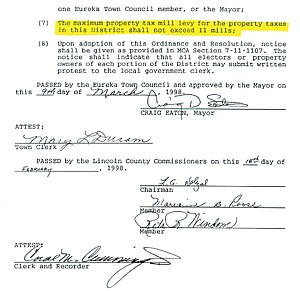

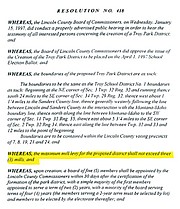

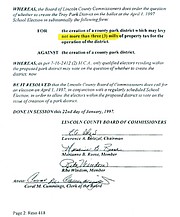

At the crux of the matter are three tax-receiving districts in Lincoln County that were formed by voters in the 1990s with the stipulation that they “shall not exceed” a specific number of tax mills. Nonetheless, since 1999, Troy Area Dispatch District has gone well beyond its 20-mill limit; Eureka Area Dispatch District has exceeded its 11-mill limit; Troy Parks and Recreation District has exceeded its three-mill limit.

There’s no question that the districts received more money than voters had approved. But the legality of levying excess taxes all comes down to Initiative 105, a 1996 statewide ballot measure that was heavily amended in subsequent years to allow some districts that operate under the oversight of county commissioners to receive floating mills to ensure consistency within district budgets.

Under Initiative 105 and its amendments, if the value of a mill were to depreciate from one year to the next, the number of assigned mills could increase to give districts a comparable amount of revenue to the previous year. The objective, according to tax experts on local and state levels, was to ensure that districts would not get shortchanged should property values plummet.

“Say you have a certain amount of money in the tax base,” former county commissioner John Konzen said. “If you lose some of the tax base, you can increase the mills to balance the money districts receive.”

Although some districts have nearly tripled their voter-approved limits, Lauer said it may be possible that floating mills authorized by Initiative 105 allow for such growth. It is unclear whether Lincoln County was authorized to allow certain mills to grow, but at the very least, Lauer said, things could have been handled better.

“Ultimately, this is going to be a good thing because of how much information we have found,” Lauer said. “We are going to be able to operate correctly going forward. Nobody in this courthouse, on these boards or the taxpayers knew about these limits.”

Experts at the county, state and national level cannot comprehend how tax-receiving districts in Lincoln County were assigned mills so far in excess of their voter-approved limits for so many years without scrutiny. Part of the problem is lack of oversight. Lauer said she believed county commissioners received district budgetary information. All three commissioners at a Friday meeting said they do not.

“I’ve never seen district budgetary information,” Eureka Commissioner Mike Cole said. “If voters approve a limit, I would think it should stay there.”

Troy Commissioner Ron Downey agreed.

“I can’t believe it can rise by itself,” Downey said. “I still can’t get through my head how a voted levy gets raised to three times from where it started. I don’t seem to ever vote on anything that raises taxes, but they keep going up.”

Harold Blattie, executive director of the Montana Association of Counties, said Initiative 105 does allow for some growth through an inflationary factor and adjustments in taxable property values. According to Montana Code Annotated 15-10-420, a district may impose a mill levy sufficient to generate the amount of revenue actually assessed or received in the prior year, plus one-half of the average rate of inflation for the past three years. So, for example, if the average rate of inflation was 3 percent per year during a consecutive three-year period, the mill rate would be allowed to increase by 1.5 percent the following year.

However, the excess tax collections were far more significant in the three districts within Lincoln County — at least during some of the years in question.

Troy Area Dispatch District has received $986,022.25 beyond its 20-mill limit since 1999. From 1999-2002, the district received 9.83 mills beyond its limit. From 2003-2005, the district annually received 19.78 mills. Mills exploded in the last four years, when it increased from 27.86 mills in 2009, to 56.86 mills in 2013. The value of a mill in 2013 was $8,694 in the district.

A similar rapid increase occurred with Troy Park and Recreation District, which has a three-mill limit. The district went from receiving 4.09 mills, in 2009 to 9.09 mills this year. A mill is valued at $6,920 in the district this year. The district has received $134,894.96 in tax revenue beyond its 1997 voter-approved limit.

Eureka Dispatch received 15.29 mills this year, 4.29 above its 11-mill limit. Early numbers indicate the district received $450,000 beyond the 11-mill limit that was established in 1998.

Blattie said he had no idea how the Troy Area Dispatch District was allowed to receive 56.86 mills when its voter-approved limit is 20. The Montana Association of Counties, which Blattie represents, was formed to protect county interests across the state and to provide services such as lobbying.

“It seems there were board members who did not understand the law,” Blattie said. “Ultimately, all property taxes in the state are levied by the commissioners. When I was a commissioner, I felt an obligation to inform (districts) of their limits. I advocate for commissioners to be hands-on with levy limitations.”

Blattie said there are no attorney general opinions or case law authoritatively ruling on the matter of floating mills. Some counties in Montana allow floating mills within the boundaries of state law, while other counties require all increases to be approved by voters.

Sandra Carlson, Flathead County director of finance, said she does not believe Initiative 105 or any other state law supersedes local voter-approved limit on mill levels for districts that operate under the purview of county commissioners.

“Unless it goes back for another vote, I think you have to keep it as is,” Carlson said.

Blattie agreed in principle, acknowledging the differences in counties.

“It is my conservative opinion that if voters approved 20 mills, that is what can be levied,” Blattie said.

Pete Sepp, executive director of the National Taxpayers Union, said taxing districts should operate under the voter-approved levies going forward.

“If, after the fact, some want to use Initiative 105 as a crutch to justify ignoring the caps that were set, then the least that can be done is to go back to the voters with new referendums seeking their input again on what the level should be,” Sepp said. “The biggest disappointment to taxpayers would be if Initiative 105 becomes some kind of legal defense for keeping the levies excessively high.”

The trouble Lauer and her office have run into is a lack of documentation. Since the issue with Troy Area Dispatch District was first uncovered, her office has scoured records as far back as the 1950s to see what, if any, additional tax limits were set by voters. It was later uncovered that Eureka Area Dispatch District and Troy Parks and Recreation District had limits as well.

County Commissioner Tony Berget requested that commissioners receive district budgetary information in the future.

“It is important to have good records,” Berget said. “We will work diligently to make sure an error like this does not happen again.”